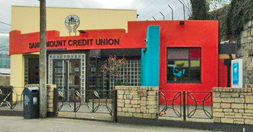

People helping People, Neighbours helping Neighbours

Before taking out a loan of any kind, it’s worth taking the time to understand the costs and how lending works. Most financial institutions which lend money are in business primarily to make a profit on the transaction. A credit union is an organisation of people – for people. It exists only to serve its members – not to profit from their needs. A credit union is a group of people who save together and lend to each other at a fair and reasonable rate of interest. Credit unions offer members the chance to have control over their own finances by making their own savings work for them.

When it comes to borrowing for the small and not so small things in life, you’ll find in Sandymount Credit Union, we understand our members’ needs. Sandymount Credit Union is in a strong position to provide loans to members and welcomes your loan application. Loans are based on what people can afford to repay and repayments are planned around individual circumstances. We encourage members to manage their money carefully by structuring loans around needs and their ability to repay.

A credit union loan has some very special features:

* Loans are insured in the event of your death at no direct cost to the eligible member. Some terms and conditions apply.

* No hidden fees or transaction charges.

* Reasonable interest rates.

* You can repay the loan earlier with no penalty.

* Additional lump sum repayments accepted with no penalty.

* Flexibility to make larger repayments than agreed with no penalty.

If you are a Sandymount Credit Union member, speak to any member of staff at the credit union about making a loan application.

If you’re not already a member, we would be delighted to invite you to join the credit union.

We Look at Things Differently – Local, Loyal, Lending